Objective

Optimize the drainage strategy of the Olympus field under uncertainty, and compare results with the reactive control drainage strategy

Solution

IRMA Drainage Strategy Optimization (DSO) application – utilizes an ensemble of models and fit-for-purpose algorithms to increase your understanding of the risks and opportunities in the subsurface.

Outcomes

- Identified 6 high risk targets that should be reconsidered.

- Increase expected net present value compared with the reactive control strategy by 133 MUSD.

- Increased expected value per well by 48%.

Project Description

Incorporate uncertainties

Relying on a single best case model to predict and optimize future reservoir performance is not robust. To make better decisions, subsurface uncertainties must be incorporated throughout the reservoir modelling, data conditioning and reservoir management processes.

Time constraints and a lack of streamlined tools often reduce this exercise to exploring a few cases and development options, or using modelling to validate prior decisions.

The IRMA Drainage Strategy Optimization (DSO) application allows asset teams to gain new insights and development options, increasing the field’s value.

Ensemble-based reservoir management

The DSO application does not rely on a single or selection of cases, but rather an ensemble of models. Asset teams can work continuously on identifying potential risks and opportunities – while capturing the subsurface uncertainty.

The Olympus field challenge highlighted where net present value was increased. It also demonstrated how to identify questionable low-value/higher risk targets. Learnings from the optimization can be used to explore alternative development scenarios for the Olympus field, accounting for all static and dynamic data in a consistent manner across the modelling chain. With the combined expertise of the subsurface team this led to an improved understanding of the field.

Solution Highlights

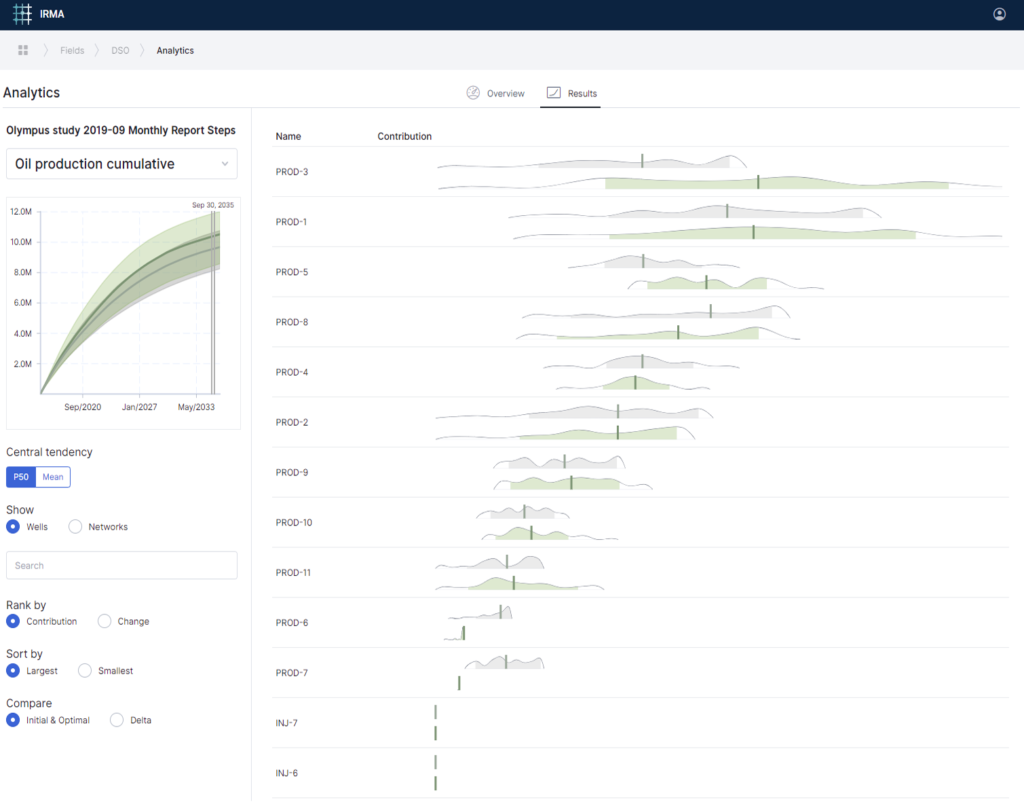

Optimize expected net present value in an ensemble of 50 pre-generated reservoir models, changing water injection rate in 7 injectors and 11 producers every two years.

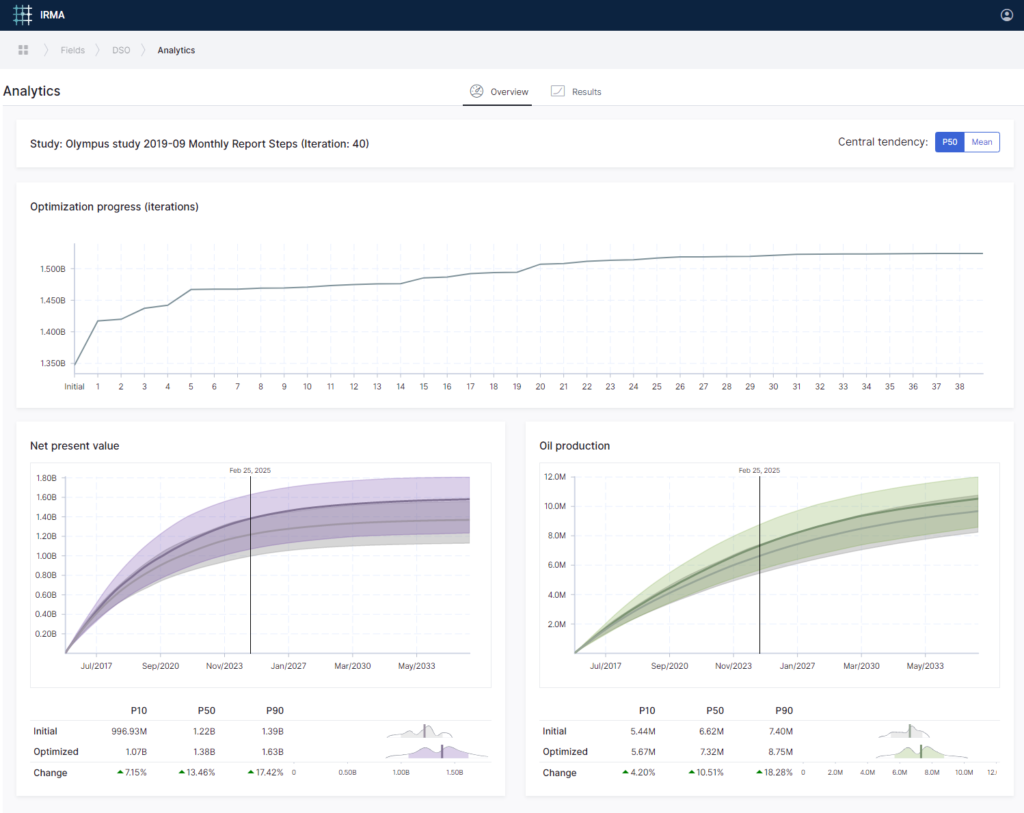

Expected NPV increase: approximately 3 % compared with the reactive control development strategy.

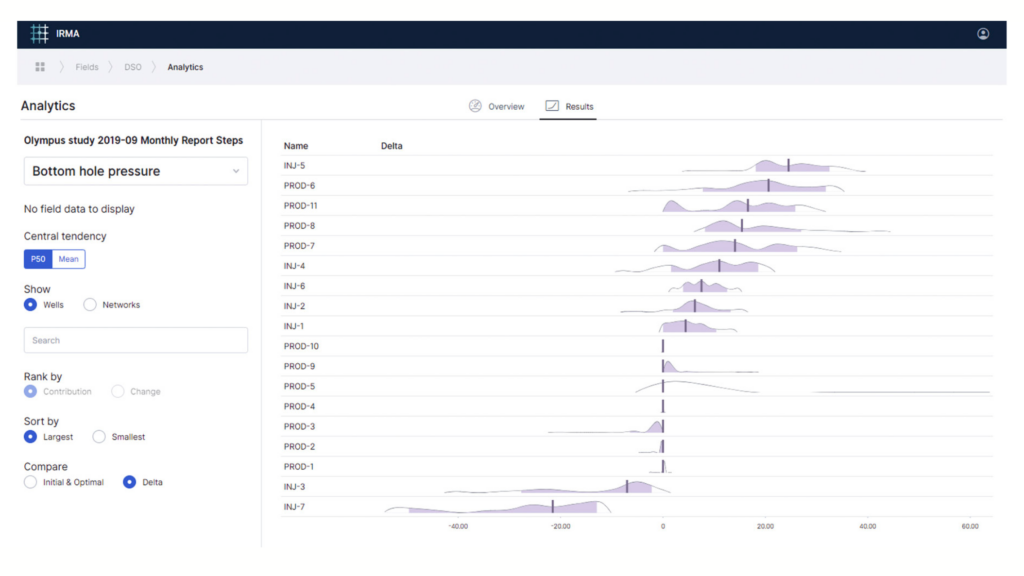

More importantly, the solution identifies six low-value/high-risk targets:

- three with limited or no value as the solution detects that the optimal solution is to switch them off.

- three with large risk of negative cash flow, when considering the cost of drilling these wells.

Running a second scenario in which we do not drill these 6 low-value/high-risks targets reveals a 163 MUSD (34 %) reduction in capital expenditure compared with the base development strategy, optimizing the placement of the platform and the wells with respect to cost of drilling.

- Expected value per well increases from 82 MUSD to 121 MUSD compared with the base development strategy.

- Expected net present value of the Olympus field increase from 1,480 MUSD to 1,610 MUSD by reducing the number of drilled wells and operating them smarter.

- Additional value is likely to be attained by exploring alternative well targets that can replace some or all the identified 6 high-risk/low value ones given the current platform capacity and available well slots.

Asset highlights

A synthetic reservoir model, OLYMPUS, inspired and loosely based on Brent-type oilfields in the North Sea, was developed for the purpose of the proposed benchmark study for field development optimization. The field is 9 km by 3 km and is bounded on one side by a fault with a large throw. In addition to the boundary fault, six smaller, internal faults are present in the reservoir. The reservoir is 50m thick and consists of two zones that are separated by an impermeable shale layer. The upper reservoir zone contains fluvial channel sands embedded in floodplain shales. The lower reservoir zone consists of alternating layers of coarse, medium and fine sands that are inclined with respect to the general structural dip of the field, so-called clinoforms. (source ECMOR XVI)

References

See the full SPE paper reference 196683